Our commitment to valuable service

Nimasq encourages clients to allow Nimasq to screen the market for socially responsible investment opportunities. We do this at no additional charge. Directing our capital to have social impact is simply the right thing to do, but there is compelling evidence which suggests that SRI screening can improve long term returns on investment:

"One obvious observation is that SRI in the United States is growing at a far faster pace than the broader universe of conventional investments. SRI assets have grown nearly 400 percent in the last 15 years from $639 billion in 1995 to $3.07 trillion in 2010. In comparison, total assets under management have only grown 260 percent over the same time period from $7 trillion to $25.2 trillion. Furthermore, no real growth has occurred in total assets under management since the beginning of the 2007 recession. However, SRI assets have increased by more than 13 percent during this same turbulent financial period. Thus, the SRI market share of total assets under management has grown by more than 3 percent over the past 15 years to 12.2 percent, or nearly one out of every eight dollars under professional management" (SIF, 2010).

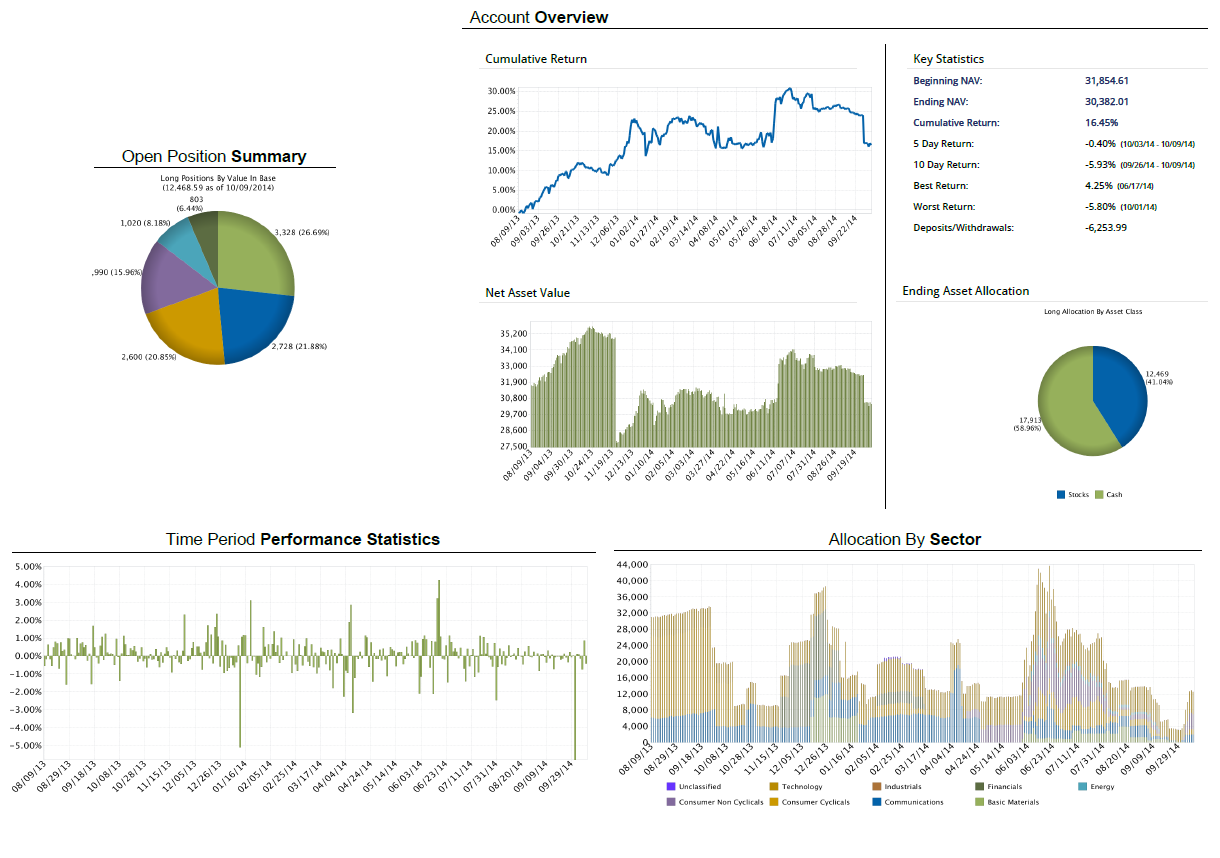

An active management portfolio strategy that rebalances the percentage of assets held in various categories in order to take advantage of market pricing anomalies or strong market sectors.

This strategy allows portfolio mangers to create extra value by taking advantage of certain situations in the marketplace. It is as a moderately active strategy since managers return to the portfolio's original strategic asset mix when desired short-term profits are achieved." (http://www.investopedia.com/terms/t/tacticalassetallocation.asp

The active disciplined performance trading techniques behind tactical asset allocation are typically reserved for clients of hedge funds. However, because Nimasq does not limit initial deposit amounts to 6 or 7 figures or require minimum holding periods - like most hedge funds do - Nimasq can competitively offer investors from all experience levels access to the sophisticated and esoteric trading strategies behind tactical asset allocation.

"A method of evaluating a security that entails attempting to measure its intrinsic value by examining related economic, financial and other qualitative and quantitative factors. Fundamental analysts attempt to study everything that can affect the security's value, including macroeconomic factors (like the overall economy and industry conditions) and company-specific factors (like financial condition and management).

The end goal of performing fundamental analysis is to produce a value that an investor can compare with the security's current price, with the aim of figuring out what sort of position to take with that security (underpriced = buy, overpriced = sell or short).

This method of security analysis is considered to be the opposite of technical analysis. (http://www.investopedia.com/terms"/f/fundamentalanalysis.asp)

"As John Maynard Keynes stated, 'There is nothing so disastrous as a rational investment policy in an irrational world.' Technical analysis provides the only mechanism to measure the 'irrational' (emotional) component present in all markets." - Nison, 11

This is a charting technique that Nimasq utilizes to efficiently grasp and perceive the state of supply vs demand from overall markets to particular securities. The picturesque analytics diplayed by candle sticks provide key support to various research and analytical techniques which Nimasq applies allowing us to make more timely decisions.

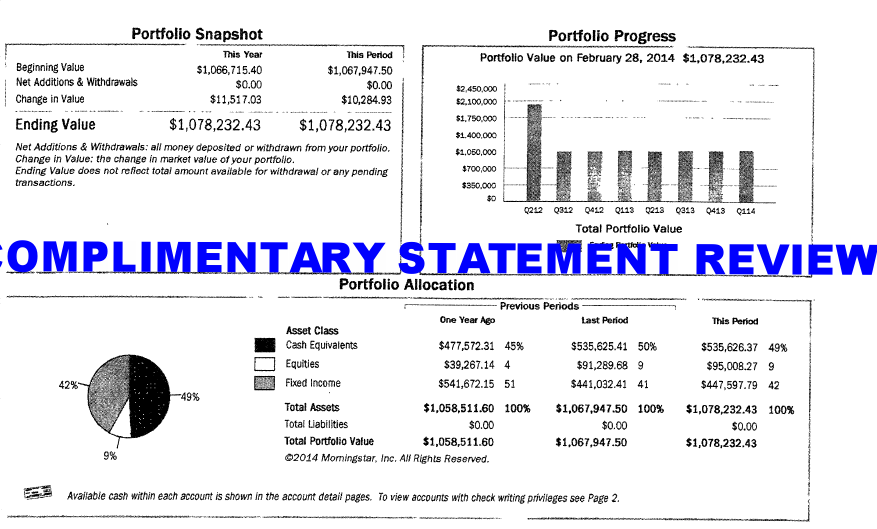

Are you finding you 401K statements befuddling? Nimasq invites you to join us at our office for a complimentary consultation and review of your quarterly investment statements. If you can't join us in person lets video conference!

We'll help break it down so you better understand your current situation and feel better informed to make decisions going forward.

Tactical Asset Allocation

Japanese Candlestick Analysis

Complimentary Consultation

Fundamental Analysis

Socially Responsible Investing

Nimasq provides the above services with a consistent philosophy, mission, and vision in mind:

Access

Nimasq offers active portfolio management by trading securities i.e. stocks, bonds, options, mutual funds, during normal market trading hours.